Inventory Genius Method: How Inventory Works

Jun 29, 2023

We're continuing on our journey through the Inventory Genius Method by taking a closer look at how inventory works. In these Inventory Genius Method posts, every story you read is real, and every business journey is a lesson for you as you make your way forward on the path to profitability.

I hope that the bite-sized, actionable steps I offer will give you the hope you are looking for and the energy to put one foot in front of the other. After all, business is hard but it doesn’t have to be complicated.

As you read, you may decide to print these posts and highlight sections you find especially important. Or, you may just decide to take notes. Please feel free to write down questions as you have them and reach out to me when you are ready for the next step or to share your realization moments with me. I want to celebrate your wins and applaud your efforts as you work to become an inventory genius!

Now, let's jump into understanding how inventory works:

If you exchange goods for dollar bills, you have inventory.

Salons that sell shampoo have inventory.

Interior design stores that sell lamps and rugs have inventory.

Subscription box businesses that send out notepads each month have inventory.

Coffee shops that sell bags of coffee beans have inventory.

The importance of inventory is so overlooked. People see inventory as cute stuff to fill up the shelves, things people can add on to their services, or a reason to go to market twice a year.

But inventory is the lifeblood of a product-based business. Your inventory will either load you down with debt, or it will create a surplus of cash.

One hundred percent of the business owners who jump on a consult with me have inventory, and over ninety percent of them don’t know how much they own without pulling up their point-of-sale system. Even then, most of them cannot find the number or have never looked before.

Yet inventory is what drives either all, or a considerable amount, of revenue through their cash registers.

I remember where I was sitting when I first realized the role inventory truly played in my business.

I had a retail business. I didn’t sell any type of service at the time, so my entire top-line sales came from selling products. You think I would have understood the importance of inventory, but remember those “what if’s” I outlined? This was one of them.

I knew I needed to stock merchandise my customers would want to buy. I knew I needed to keep up on trends, and I understood how to buy a good deal. I had an outlet store, and we bought everything off price.

It wasn’t as if I lacked knowledge of cost structure or even the idea of margin. However, I didn’t really grasp how much inventory impacted whether a business survived and thrived, until that day.

I was sitting in our first little warehouse. We had moved from our original flagship store downtown to a new, hopping location by the mall. Dozens of shoppers would drive by our store on their way from Target to TJ Maxx. We had our own parking lot, a massive storefront with numerous windows, and enough space to take the back half of the store and turn it into a little warehouse. By the time of the move, we had several franchised locations open, and we supplied all the inventory for our franchisees. We also functioned as their bank. We will cover more on being the bank later in another post.

Because we purchased all the inventory, repackaged it, and sent it out to the other locations, the little back room of our original location was bursting at the seams. We needed a warehouse.

I was so proud of the new location. With only a solid door between the store and the warehouse, I could be present for both my customers and my team. Before the store opened each day, I could help organize inventory, use our sweet little forklift to unload any trucks that had arrived, and even jump on a call with a vendor or supplier. When the store opened at 10 a.m., I was able to pop out front and help customers at the fitting room or restock the store.

Life felt so good!

By this time, we were moving through hundreds of thousands of units every month. One unit is one thing to sell, such as a shirt, a pair of shoes, or a picture frame. I was selling excess inventory to other mom-and-pop stores around the country. That top-line number looked fantastic!

But where was all the cash going? It came in, and then poof, the bank account was low again, all in what seemed to be a matter of hours. In and out, the cash flew through the business like a raging river.

The sales come in. The high was real! This time it will be different. This time I will pay all the bills and finally be able to breathe. Then, just as fast, the cash was gone. Where did it all go? How could I have just had the best weekend of the year and still feel broke?

I am guessing you are nodding and loudly yelling, “Yes! That’s me!”

It’s all in the inventory.

Back to that day. The day I had an “ah ha” moment about my inventory. I was sitting at my desk in the little warehouse. I can still see the budget spread out in front of me and feel the confusion welling up in the pit of my stomach. “I don’t understand where all the money is going,” I said to our accountant.

“Ciara, just because you buy something for $5 and sell it for $10 doesn’t mean you have $5 left. It costs x amount to turn on the lights, and x amount to pay your people, x amount to advertise and x amount to buy supplies. You are lucky if you even have a dollar left at the end of the day.”

Those were his literal words. I can still hear them clear as day because it was at that very moment I realized my inventory was everything!

In that moment I understood that I had to buy the right inventory and the right amount of it. I needed to understand how to price it up and when to mark it down. Categories and margin and turn meant everything. Inventory is cash, and there was cash everywhere in my business. On the racks in my store, in the bins on the shelves, in the boxes that just arrived. I had to learn how to manage that cash and turn it into more or I would be forever broke and eventually out of work.

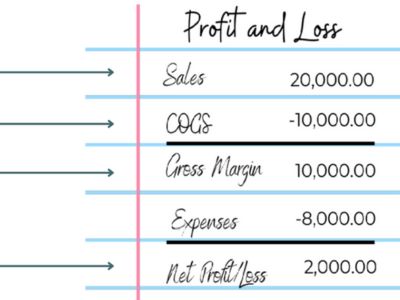

If you take a look at a profit and loss statement, you’ll see that inventory is directly tied to four of the five main sections. That’s a pretty big deal.

Let’s break down how inventory really works by looking at each of the categories it is directly tied to.

Financials: The Sales

First, the sales. At first glance, this is a no brainer, right? We intuitively know the sales are from the inventory.

However, simply focusing on this huge, top-line number without truly digging into its source will most assuredly make us miss out on opportunity.

Financials: The Cost of Goods Sold

Second, the cost of goods sold, or COGS. This is the most misunderstood number on a profit and loss statement.

On a recent call, a client, let’s call her Jane, and I focused on breaking down her financials. Wildly successful in her industry, Jane had been in business for around four years and had done so many things right. She had an amazing product, a clearly defined brand, and the ability to sell. Her top-line revenue would be the envy of many, and she was running a lean-and-mean business model. However, she had deeply rooted anxiety and shame because she did not know how to read her financials.

Having had a bookkeeper since the beginning, Jane had been receiving monthly financial statements almost since her business launched, but like so many other small business owners, she would receive the statement, save it to a file on her laptop, and move on to the parts of her business she loved and understood, that is until she met me. I told her we could demystify the financials and break down the numbers, so she could get a clear understanding of what her books were telling her about her business.

This call was our first attempt to tackle this project. As I walked her through what to do when she was sent the financial statement each month, I pointed out that in month one and two, her business showed an average of a 10% gross margin. Month three showed us she had over an 80% gross margin! Now, while we would love running an inventory-based business at an 80% margin, the abrupt increase told us that something with the cost of goods sold was way off.

This, my friend, is why it is imperative to learn your numbers. You must be able to glance through your monthly profit and loss statement and balance sheet and find any red flags within five minutes. Even accountants can get it wrong!

So, what is the cost of goods sold (COGS), and how should it be accurately recorded?

Cost of goods sold is, simply put, the cost of the inventory you’ve sold. It is not just the cost of what you bought at market or ordered from the supply company. It is literally the cost associated with the inventory that is represented in the sales number directly above it.

Let me explain how inventory flows in and out of your financials.

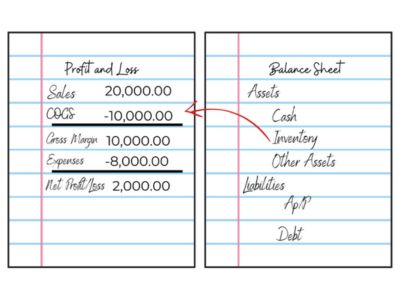

When you make a purchase, that inventory becomes an asset to you.

The Oxford Dictionary defines an asset as “property owned by a person or company, regarded as having value and available to meet debts, commitments, or legacies.”

In other words, if something has value to your business and can be sold or turned into cash, it is an asset. Inventory is an asset. In fact, inventory for a product-based business is most likely your biggest asset! Therefore, when you make an inventory purchase, the first thing you should do is list that transaction on your balance sheet as an inventory asset. As you make inventory purchases, the total of this category increases, and as you sell inventory, it decreases. The value of inventory that you own will grow and shrink depending on the purchasing and sales activities in your business. When there are sales, the costs associated with those sales are subtracted from the inventory asset total on the balance sheet and moved over to the cost of goods sold line on the profit and loss statement. Once the inventory is sold, it is expensed out of your system. You no longer own that asset, as you have now turned it into cash!

One of the biggest mistakes I see product-based business owners make is to enter their inventory purchases as expenses on their profit and loss statement, while skipping the balance sheet altogether. However, when this is recorded improperly, you will find yourself in the exact scenario as my client, Jane—you will look at the profit and loss and not be able to decipher an accurate margin. This brings us to the next stop on the financials, your gross margin.

Financials: The Gross Margin

Gross margin is the difference between the sales and the cost of those sales. When I work with a new client, we focus on increasing margin before we ever look at increasing top-line revenue. What?!?

Without correct numbers, you can’t focus on the right work to do.

Take Karen and Tonya, for example. A mother-daughter team with a thriving boutique business, they had all the top-line sales and no money to show for it. Both of them desperately desired a paycheck and were constantly stressed about making the next rent payment. They didn’t understand how the money kept flowing in, yet none of it ever seemed to stick around long enough to offer relief. They hired me to take a deep dive into their financials and show them what they were missing.

“Margin,” I said. “You are missing margin.”

Remember that lesson I learned from my accountant, the one for which I realized that even though I could buy for five and sell for ten, I could still be left in the hole? That’s a margin problem.

Payroll, rent, marketing, traveling—these all cost something. The sales of our inventory have to cover all of those costs. If we sell ourselves short (literally!), we won’t have enough to cover them, even if we have a million dollars in sales. When you grow and scale your business, you most often grow and scale your expenses and your problems, too, and if you don’t fatten up that margin, you will always be behind, just like Karen and Tonya were.

Before we worked on finding more customers or cutting back on expenses, we tackled increasing their margin. I told them to go through their store and increase the price of every single item by one dollar. Every single thing. Whether it was a pair of shoes or a pair of earrings, every item had to be increased by one dollar. Then I told them to report back after a couple weeks and tell me how much they made in top-line sales, along with how much they would have made if those exact same items sold at their old prices. That difference was their new margin.

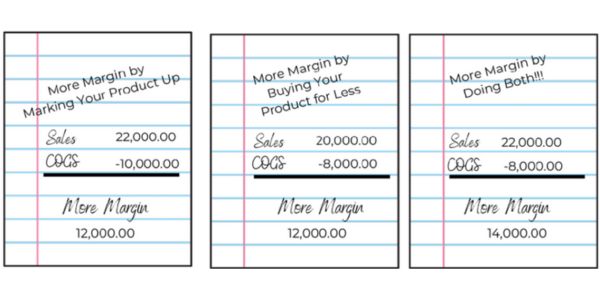

Margin matters. As with anything in your business, you can slice and dice it several different ways (Take note of that as it will be key to becoming an inventory genius! There are always multiple ways to solve a problem).

Margin can be won by marking your product up, buying your product for less, or doing both. Let me illustrate.

Now you can see why it is imperative to record your inventory sales and the cost of those sales accurately. If you record your inventory purchases only on your profit and loss statement, your margin will be skewed. Without correct numbers, you can’t focus on the right work to do. When you don’t do the right work, you will keep spinning your wheels.

Now you can see why it is imperative to record your inventory sales and the cost of those sales accurately. If you record your inventory purchases only on your profit and loss statement, your margin will be skewed. Without correct numbers, you can’t focus on the right work to do. When you don’t do the right work, you will keep spinning your wheels.

Let’s move on to the fourth area on the profit and loss statement—the expense section.

Financials: The Expenses

This is the only area of your financials that has nothing to do with inventory. The expense section is going to reflect all of the fixed and non-fixed expenses in your business—things like payroll, rent, marketing, travel, meals, subcontractors, utilities, and supplies. Shipping expenses can show up here (although costs to get your inventory to your store should really be reflected in the cost of goods sold section).

Every cost to run your business will be reflected in the expense section of your profit and loss statements. Debt does not show up here. Inventory never shows up here. And while there is nothing inventory related in this section, it is so important that you record all of your monthly expenses accurately. If you leave things out, if you hide receipts from your bookkeeper, or, worse yet, if you never keep the receipts in the first place, you will never see the true picture. Until we can see the true—and entire—picture, we cannot fix the problem!

The Financials: The Net Profit

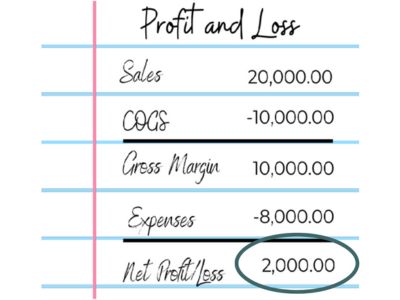

So, we have your sales, and we subtract the cost of goods sold to give us your margin. Next, we list your expenses, and we subtract that from the gross margin, and that yields the last number, your net profit or loss.

This is the number we do the work for! We focus on doing the right work to increase this number. And guess what? This number is directly tied to an accurate representation of the cost of goods sold at the top of the page! Remember my friend Jane? Because her bookkeepers inaccurately entered her inventory purchases on her profit and loss statement instead of into the cost of goods sold section, one month showed a whopping $40,000 in profit, and the other two months showed terrible losses. You can’t focus on the right things and do the right work if you don’t know the truth of what is going on in your business. At the end of the day (or the end of the month), accurate records matter. It matters that everything is entered properly and in a timely fashion.

Without accurate information, you cannot focus on what matters because your perception of reality is extremely skewed. The feeling of being completely overwhelmed and never really knowing where your business stands will be your constant companion if you don’t have an accurate picture of your business.

If I think I made $40,000 last month, yet I only have $2,500 in my bank account, of course I will feel like a failure! If I see a constant loss on my financials, of course I will feel as though there is no point. Of course, I will question what on earth I am doing wrong.

When inventory geniuses look at their financials, they know the numbers are telling the truth. They don’t have it all together; in fact, they might even have a mess on their hands, but they know where they stand. The first step in becoming an inventory genius is to dump the puzzle out on the table in front of you, flip over the puzzle pieces, and know that every piece has a place. Even if that pile of pieces looks like a mess, an inventory genius will know where every piece goes, and the puzzle can begin to be put together, one piece at a time.

Let’s look at two scenarios.

Scenario One: You know the numbers on your profit and loss statement are accurately recorded, yet you still find a net loss when you scroll to the bottom. What should you do?

Scenario Two: You know your numbers are accurately reported, and you see an amazing net profit, but you scratch your head because there is still nothing in your bank account. What’s next?

In scenario one, we can focus on one of three things, or a combination of all three:

- Increase sales

- Increase margin

- Lower expenses

In scenario two, we need to take a deep dive into your balance sheet. There we will find the answer to where all the money is going.

In the next Inventory Genius Series post, we'll talk about scenario one and figure out how to change that bottom number from a negative to a number that quickly becomes your positive best friend. Stay tuned!

If you're looking for next steps beyond these blog posts, I invite you to get started with the Quickstart to Inventory Genius.

The Quickstart is my keystone coaching roadmap. Three modules will quickly layout five things to focus on in your inventory based business. You can implement these five strategies right away in order to drive immediate profit. And with the Quickstart, I GUARANTEE that you'll double your investment through either making, saving, or finding that amount in PROFIT. The Quickstart really is the perfect way to get your inventory based business on the right track.

Looking for related posts?